8 Tactics for Optimizing Working Capital and Strengthening Financial Health

Maintaining a strong financial foundation is crucial for the success and longevity of any company. One key aspect of achieving this goal is optimizing working capital, which refers to the funds available for day-to-day operations.

1. Streamline Inventory Management

Effective inventory management is essential for optimizing working capital. Overstocking can tie up valuable funds, while understocking can lead to lost sales and customer dissatisfaction. To strike the

right balance, consider the following:

- Implement a robust inventory tracking system to monitor stock levels in real-time

- Analyze historical sales data to identify trends and forecast future demand accurately

- Establish optimal reorder points and safety stock levels to minimize excess inventory

- Regularly review and adjust inventory levels based on changes in market conditions or customer

preferences

By streamlining your inventory management processes, you can reduce carrying costs, improve cash flow,

and ensure that you have the right products available when customers need them.

2. Optimize Accounts Receivable

Managing accounts receivable is critical for maintaining a healthy cash flow. Late payments from customers can strain your working capital, making it difficult to meet your own financial obligations.

To optimize your accounts receivable, consider the following strategies:

- Establish clear payment terms and communicate them to customers upfront

- Offer incentives for early payment, such as discounts or loyalty rewards

- Implement a systematic invoicing process to ensure timely and accurate billing

- Regularly monitor outstanding invoices and follow up with customers to encourage prompt payment

- Consider using factoring or invoice financing to accelerate cash flow from receivables

By proactively managing your accounts receivable, you can reduce the risk of late payments, improve

cash flow, and strengthen your overall financial position.

3. Negotiate Favorable Payment Terms with Suppliers

Just as it's important to optimize accounts receivable, it's equally crucial to manage accounts

payable effectively. Negotiating favorable payment terms with your suppliers can help you conserve working capital and improve cash flow. Consider the following approaches:

- Build strong relationships with suppliers to establish trust and facilitate negotiations

- Request extended payment terms, such as net 60 or net 90 days, to provide more flexibility in

managing cash outflows - Explore early payment discounts offered by suppliers to reduce overall costs

- Consolidate purchases with fewer suppliers to increase bargaining power and secure better terms

- Regularly review supplier contracts and renegotiate terms as necessary to align with your financial goals

4. Implement Just-in-Time (JIT) Inventory Practices

Just-in-Time (JIT) inventory management is a lean approach that aims to minimize inventory holding costs by receiving goods only when they are needed for production or sales. By adopting JIT practices, you can:

- Reduce inventory carrying costs, such as storage, insurance, and obsolescence

- Improve cash flow by minimizing funds tied up in inventory

- Enhance supply chain efficiency by aligning inventory levels with actual demand

- Foster closer collaboration with suppliers to ensure timely and accurate deliveries

- Increase flexibility to adapt to changes in customer preferences or market conditions

Implementing JIT inventory practices requires careful planning, reliable suppliers, and efficient

logistics management. When executed effectively, JIT can significantly optimize working capital and improve overall financial health.

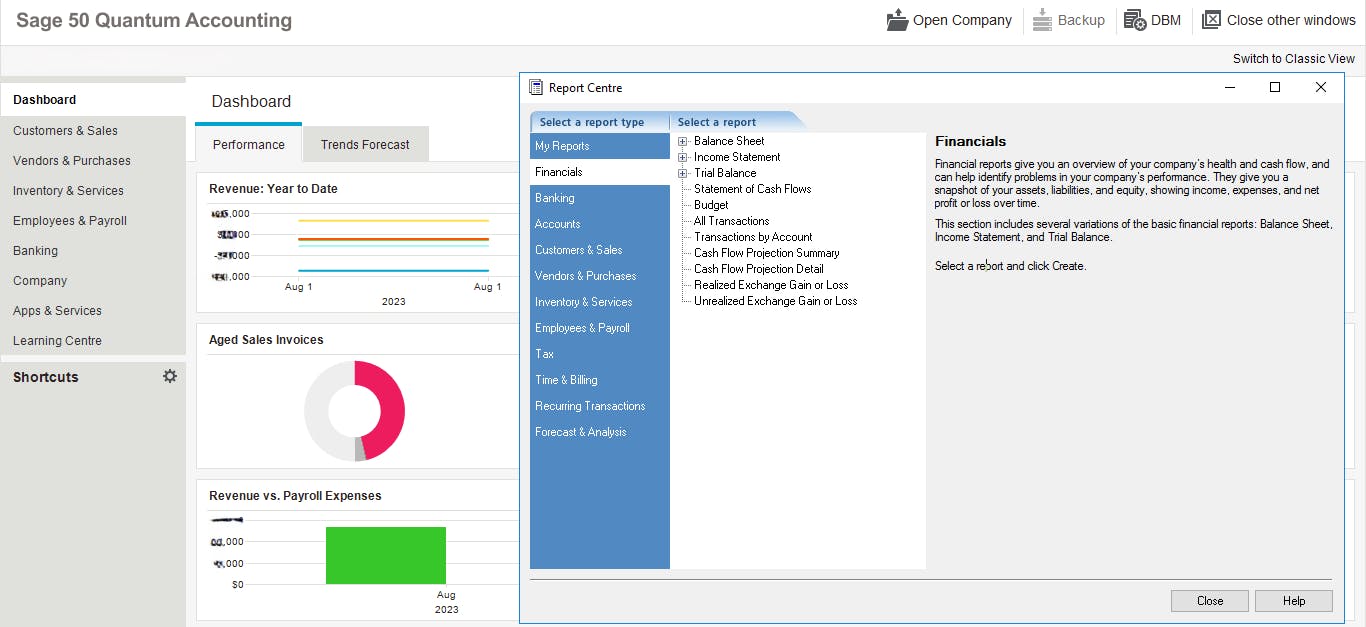

5. Leverage Technology for Financial Management

Technology can be a powerful ally in optimizing working capital and strengthening financial health. By leveraging the right tools and systems, you can:

- Automate financial processes, such as invoicing, payment processing, and cash flow forecasting

- Gain real-time visibility into financial performance through dashboards and analytics

- Streamline communication and collaboration among finance team members and other departments

- Reduce manual errors and improve data accuracy through automated data capture and validation

- Enable faster decision-making by providing timely and actionable financial insights

Investing in the right financial management technology can help you optimize working capital, reduce costs, and drive overall financial performance.

6. Conduct Regular Cash Flow Forecasting

Cash flow forecasting is a critical tool for managing working capital effectively. By projecting

future cash inflows and outflows, you can:

- Anticipate potential cash shortages or surpluses and take proactive measures to address them

- Identify opportunities to invest excess cash or secure additional financing when needed

- Align spending and investment decisions with available cash resources

- Monitor the impact of changes in sales, expenses, or market conditions on cash flow

- Communicate cash flow expectations to stakeholders, such as investors or lenders

Regular cash flow forecasting, such as on a weekly or monthly basis, can help you stay on top of your working capital needs and make informed financial decisions.

7. Optimize Debt and Financing Strategies

Effective debt and financing strategies can play a crucial role in optimizing working capital and

strengthening financial health. Consider the following approaches:

- Evaluate various financing options, such as lines of credit, term loans, or asset-based lending, to determine the most suitable solution for your business

- Negotiate favorable terms and interest rates with lenders to minimize borrowing costs

- Align debt repayment schedules with expected cash inflows to avoid liquidity crunches

- Regularly review and adjust your debt portfolio to ensure it aligns with your financial goals and risk tolerance

- Consider alternative financing options, such as crowdfunding or venture capital, for growth

initiatives or special projects

By optimizing your debt and financing strategies, you can access the funds needed to support

operations and growth while minimizing the impact on working capital.

8. Foster a Culture of Financial Discipline

Finally, optimizing working capital and strengthening financial health requires a company-wide

commitment to financial discipline. Encourage a culture that values:

- Prudent spending habits and cost-consciousness across all levels of the organization

- Timely and accurate financial reporting to enable informed decision-making

- Collaboration and communication among finance, operations, and other departments

- Continuous improvement and innovation in financial processes and practices

- Accountability and ownership for financial performance at both individual and team levels

By fostering a culture of financial discipline, you can engage employees in the pursuit of working

capital optimization and create a shared sense of responsibility for the company's financial success.

Conclusion

Optimizing working capital and strengthening financial health are ongoing processes that require diligence, discipline, and a proactive approach. By implementing the eight tactics discussed in this post – streamlining inventory management, optimizing accounts receivable and payable, leveraging JIT practices and technology, conducting regular cash flow forecasting, optimizing debt and financing strategies, and fostering a culture of financial discipline – you can enhance your company's cash flow, reduce financial risks, and position your business for long-term success.