10 Cash Flow Killers and How to Avoid Them at All Costs

Cash flow is the lifeblood of any business. Without a steady stream of cash coming in, it's impossible to keep the lights on, pay employees, or invest in growth. Unfortunately, there are many common mistakes that can quickly derail your cash flow and put your business at risk.

In this post, we'll explore ten of the most dangerous cash flow killers and provide practical tips on how to avoid them. By understanding these pitfalls and taking proactive steps to prevent them, you can ensure that your business stays on track and continues to thrive.

1. Failing to Monitor Your Cash Flow

One of the biggest mistakes business owners make is failing to keep a close eye on their cash flow. It's easy to get caught up in the day-to-day operations of your business and lose sight of the bigger picture.

To avoid this cash flow killer, make it a habit to review your financial statements regularly. Set aside time each week or month to analyze your income and expenses, and look for any potential problems or opportunities for improvement.

Tips for Monitoring Your Cash Flow

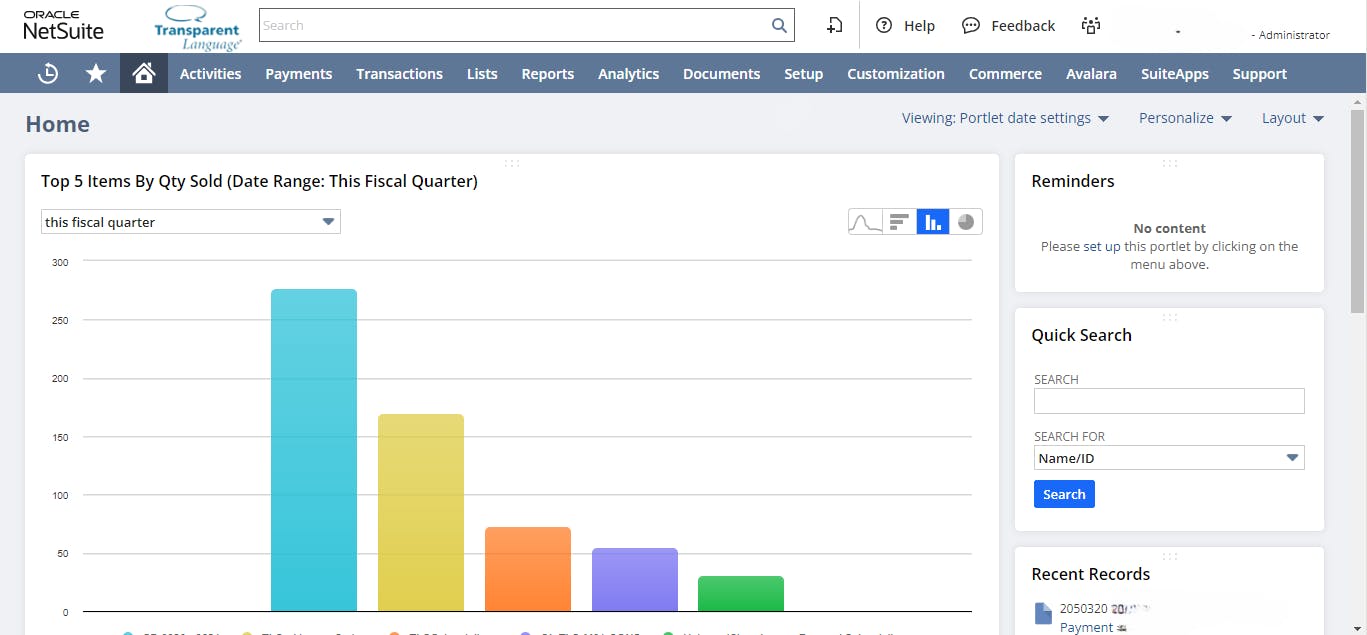

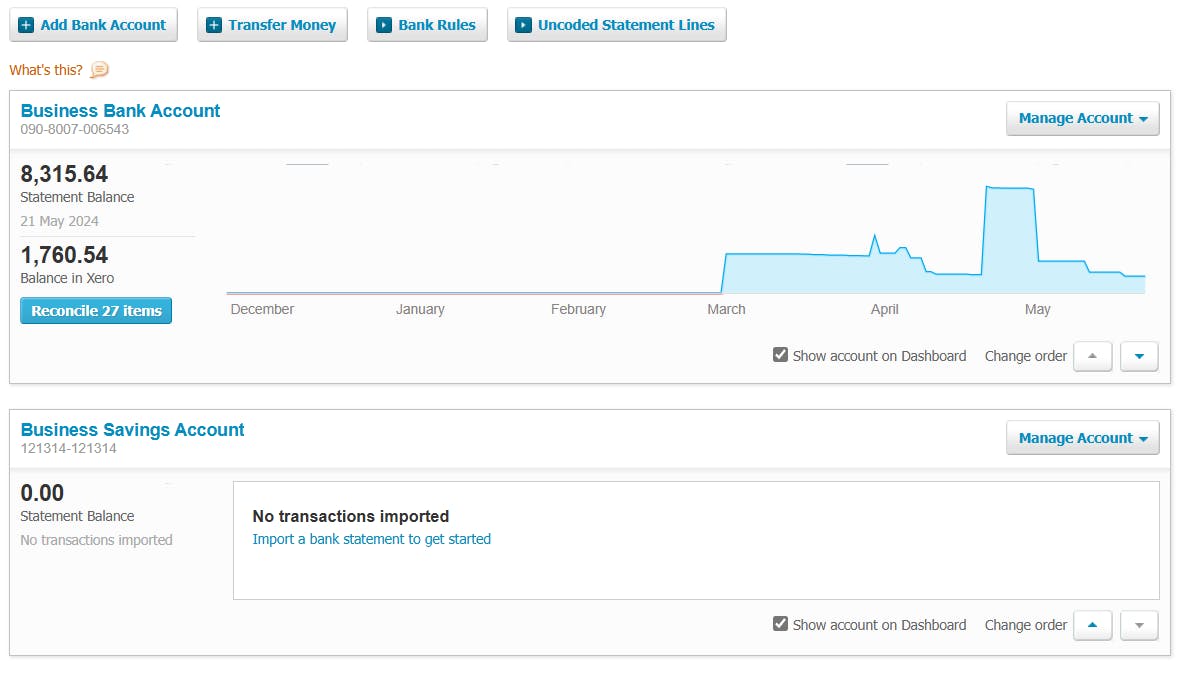

- Use accounting software to track your income and expenses in real-time

- Create a cash flow forecast to anticipate future cash needs

- Regularly review your accounts receivable and payable to ensure timely payments

2. Overextending Your Credit

Another common cash flow killer is overextending your credit. When times are tough, it can be tempting to rely on credit cards or loans to keep your business afloat. However, this can quickly spiral out of control and leave you with unmanageable debt.

To avoid this pitfall, be cautious about taking on new debt. Only borrow what you absolutely need, and make sure you have a clear plan for how you'll repay the money.

Tips for Managing Your Credit

- Shop around for the best interest rates and terms

- Pay more than the minimum payment whenever possible

- Avoid using credit for non-essential expenses

3. Neglecting to Invoice Promptly

If you're not invoicing your customers promptly, you're essentially giving them an interest-free loan. This can quickly eat into your cash flow and leave you struggling to pay your own bills.

To avoid this cash flow killer, make it a priority to invoice your customers as soon as the work is completed. Consider using automated invoicing software to streamline the process and ensure that nothing falls through the cracks.

Tips for Prompt Invoicing

- Set clear payment terms upfront and communicate them to your customers

- Send invoices electronically to speed up the payment process

- Follow up on overdue invoices promptly and professionally

4. Failing to Manage Your Inventory

If you're in a product-based business, managing your inventory is crucial to maintaining healthy cash flow. Overstocking can tie up valuable cash in unsold products, while understocking can lead to lost sales and disappointed customers.

To avoid this cash flow killer, implement a robust inventory management system. Use data to forecast demand and adjust your orders accordingly, and regularly review your inventory levels to identify any slow-moving or obsolete items.

Tips for Managing Your Inventory

- Use an inventory management software to track your stock levels in real-time

- Implement a just-in-time (JIT) inventory system to minimize excess stock

- Regularly review your inventory turnover and adjust your purchasing accordingly

5. Overspending on Non-Essential Expenses

It's easy to get caught up in the excitement of running a business and overspend on non-essential expenses. Whether it's fancy office furniture or expensive marketing campaigns, these costs can quickly add up and eat into your cash flow.

To avoid this cash flow killer, be ruthless about cutting unnecessary expenses. Regularly review your spending and look for areas where you can trim the fat without sacrificing quality or customer service.

Tips for Cutting Non-Essential Expenses

- Shop around for the best deals on supplies and services

- Negotiate better rates with your vendors and suppliers

- Implement a budget and stick to it

6. Failing to Plan for Seasonality

Many businesses experience seasonal fluctuations in demand, which can make cash flow management a challenge. If you're not prepared for these ups and downs, you may find yourself struggling to make ends meet during slower periods.

To avoid this cash flow killer, plan ahead for seasonality. Use historical data to forecast your cash needs during different times of the year, and set aside funds during peak periods to cover expenses during slower times.

Tips for Planning for Seasonality

- Create a cash flow forecast that accounts for seasonal fluctuations

- Build up a cash reserve during peak periods to cover expenses during slower times

- Consider offering promotions or discounts during slower periods to boost sales

7. Neglecting to Collect on Overdue Invoices

If you're not actively pursuing overdue invoices, you're essentially giving your customers permission to pay late. This can quickly snowball into a major cash flow problem, as you're left waiting for payments that may never come.

To avoid this cash flow killer, implement a rigorous collections process. Follow up on overdue invoices promptly and professionally, and consider offering incentives for early payment or penalties for late payment.

Tips for Collecting on Overdue Invoices

- Set clear payment terms upfront and communicate them to your customers

- Send reminders before invoices are due to encourage timely payment

- Consider using a collections agency for particularly stubborn cases

8. Failing to Diversify Your Revenue Streams

Relying on a single customer or revenue stream can be a major risk to your cash flow. If that customer goes out of business or decides to take their business elsewhere, you could be left scrambling to find new sources of income.

To avoid this cash flow killer, diversify your revenue streams. Look for ways to expand your customer base, offer new products or services, or explore new markets.

Tips for Diversifying Your Revenue Streams

- Conduct market research to identify new opportunities for growth

- Consider partnering with complementary businesses to expand your reach

- Explore new sales channels, such as online marketplaces or wholesale distribution

9. Neglecting to Plan for Taxes

Taxes are a fact of life for any business, but failing to plan for them can be a major cash flow killer. If you're not setting aside funds throughout the year to cover your tax obligations, you may find yourself scrambling to come up with the money when tax time rolls around.

To avoid this pitfall, work with a tax professional to estimate your tax liability and set aside funds each month to cover it. Consider opening a separate bank account specifically for tax payments to ensure that the money is available when you need it.

Tips for Planning for Taxes

- Work with a tax professional to estimate your tax liability

- Set aside funds each month to cover your tax obligations

- Consider making quarterly estimated tax payments to avoid a large bill at the end of the year

10. Failing to Seek Professional Advice

Finally, one of the biggest cash flow killers is failing to seek professional advice when you need it. Whether it's a financial advisor, accountant, or business coach, having a trusted expert in your corner can help you avoid costly mistakes and make better decisions for your business.

To avoid this pitfall, don't be afraid to ask for help when you need it. Seek out mentors and advisors who have experience in your industry, and be open to their feedback and guidance.

Tips for Seeking Professional Advice

- Identify areas where you need help and seek out experts in those fields

- Be open to feedback and willing to make changes based on their advice

- Consider joining a business networking group or attending industry events to connect with other professionals

By avoiding these ten cash flow killers and implementing these practical tips, you can ensure that your business has the steady stream of cash it needs to thrive. Remember, cash flow management is an ongoing process, so stay vigilant and always be on the lookout for ways to improve your financial health.