Accounting for Success: Strengthening Financial Foundations in Your Firm

Let's have a heart-to-heart about the backbone of any successful company – accounting. I know, I know, it might not be the most exciting topic, but trust me, mastering the art of accounting is like having a superpower when it comes to running your firm efficiently and profitably.

The Importance of Solid Financial Foundations

Think about it this way: your business is like a sturdy building, and accounting is the foundation upon which it stands. Without a strong foundation, even the most beautiful skyscraper would crumble. Similarly, without proper accounting practices in place, your business could face financial turbulence, making it challenging to make informed decisions, manage cash flow, and plan for growth.

Understanding the Accounting Basics

Before we dive into the nitty-gritty, let's cover the basics. Accounting is essentially the process of recording, classifying, and summarizing financial transactions to provide useful information for decision-making. It's like having a detailed map that guides you through the financial landscape of your business.

The three main financial statements you'll need to be familiar with are:

- Balance Sheet: This statement provides a snapshot of your company's assets, liabilities, and equity at a specific point in time. It's like taking a picture of your firm's financial health.

- Income Statement: Also known as the profit and loss statement, this document shows your company's revenues, expenses, and ultimately, net income or loss over a given period. It's like a report card that evaluates your firm's profitability.

- Cash Flow Statement: This statement tracks the inflow and outflow of cash within your business, helping you understand where your money is coming from and where it's going. It's like a financial GPS, ensuring you never run out of fuel (cash) on your journey.

Implementing Effective Accounting Practices

Now that we've covered the basics, let's dive into some practical tips to strengthen your firm's accounting foundations:

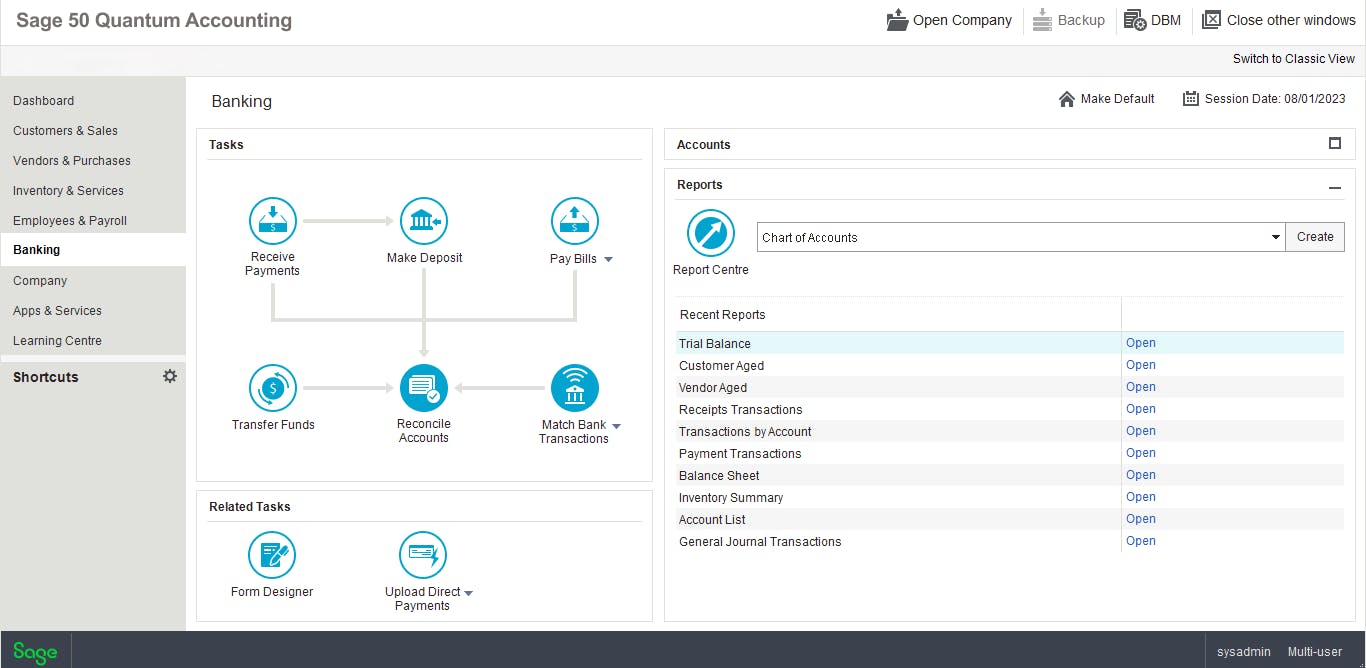

1. Invest in Accounting Software

Gone are the days of pen and paper accounting. In today's digital age, investing in robust accounting software can streamline your processes, reduce errors, and provide real-time financial insights. Think of it as hiring a virtual accountant that never takes a day off.

2. Develop Clear Accounting Policies and Procedures

Consistency is key when it comes to accounting. Develop clear policies and procedures for recording transactions, managing accounts receivable and payable, and reconciling accounts. This ensures that everyone in your firm is on the same page, reducing the risk of errors and miscommunication.

3. Prioritize Accurate Record-Keeping

Accurate record-keeping is the backbone of sound accounting practices. Make sure to diligently record every transaction, whether it's a sale, expense, or investment. Treat your accounting records like sacred scrolls, for they hold the key to understanding your firm's financial performance.

4. Embrace Financial Reporting and Analysis

Don't just let your financial data collect dust in a spreadsheet. Embrace regular financial reporting and analysis to gain valuable insights into your firm's performance, identify areas for improvement, and make data-driven decisions. Think of it as having a crystal ball that reveals the future of your business.

5. Outsource or Hire Accounting Expertise

Let's be real – accounting can be a complex and time-consuming endeavor, especially for small businesses and startups. If you don't have the in-house expertise or resources, consider outsourcing your accounting needs to a professional firm or hiring a qualified accountant. It's like having a financial superhero on your team, ready to swoop in and save the day.

The Benefits of Strong Accounting Practices

By implementing these effective accounting practices, you'll unlock a world of benefits for your firm:

- Better Financial Control: With accurate financial data at your fingertips, you'll have a tighter grip on your firm's financial reins, enabling you to make informed decisions and course corrections as needed.

- Improved Cash Flow Management: Proper accounting practices will help you track and manage your cash flow more effectively, ensuring you always have enough liquidity to keep your business running smoothly.

- Enhanced Compliance: Adhering to accounting standards and regulations will help you stay compliant with tax laws, industry regulations, and reporting requirements, avoiding costly penalties and legal troubles.

- Increased Credibility: Solid accounting practices demonstrate professionalism and transparency, boosting your firm's credibility with stakeholders, lenders, and potential investors.

- Stronger Growth Potential: With a clear understanding of your firm's financial performance and future projections, you'll be better equipped to identify growth opportunities, secure funding, and make strategic investments.

Final Thoughts

Accounting might not be the most glamorous aspect of running a business, but it's undoubtedly one of the most crucial. By strengthening your firm's financial foundations through effective accounting practices, you'll be setting yourself up for long-term success. Remember, a strong foundation can withstand even the mightiest storms, allowing your business to thrive and grow in any economic climate.

So, embrace accounting as your secret weapon, and watch as your firm soars to new heights of financial prosperity. After all, as the saying goes, "Accounting is the language of business, and those who speak it fluently have a competitive edge."