Why Switch from NetSuite to QuickBooks Online

Reasons why some businesses choose to migrate from NetSuite, an ERP system, to QuickBooks Online, an accounting solution.

The best tool is the one that works for you. Don't let anyone tell you that bigger is always better. Sometimes, simpler is smarter.

You often don't need a fancy, expensive hammer to screw a bolt. And sometimes, you don't need a full-fledged ERP system like NetSuite to manage the accounting of your business.

In this post, I want to help you explore some reasons why a business may choose to migrate from NetSuite to QuickBooks Online.

Features: Do You Really Need All Those Bells and Whistles?

Look, NetSuite is a powerhouse. It's got all these fancy features like advanced inventory management and multi-entity consolidation. But here's the thing - are you actually using all that stuff?

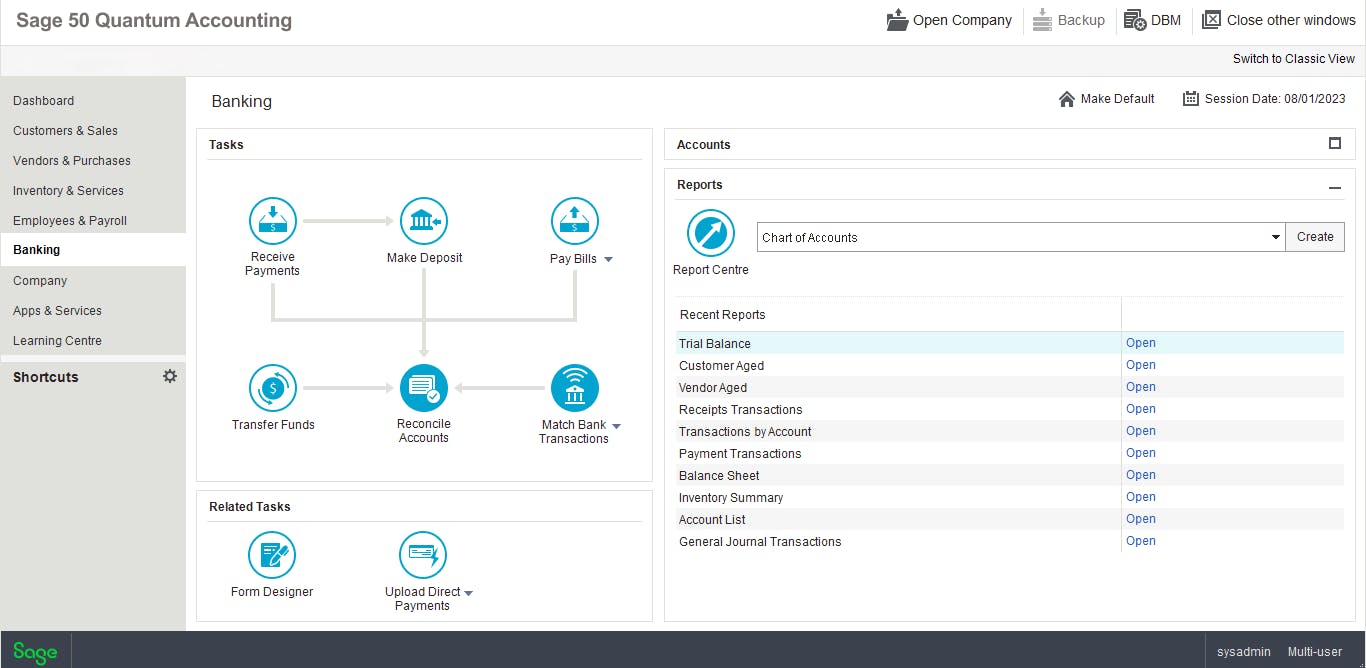

QuickBooks Online might not have all the frills, but it's got the essentials down pat:

- Solid core accounting features

- Basic inventory management (which is often enough)

- Payroll integration that just works

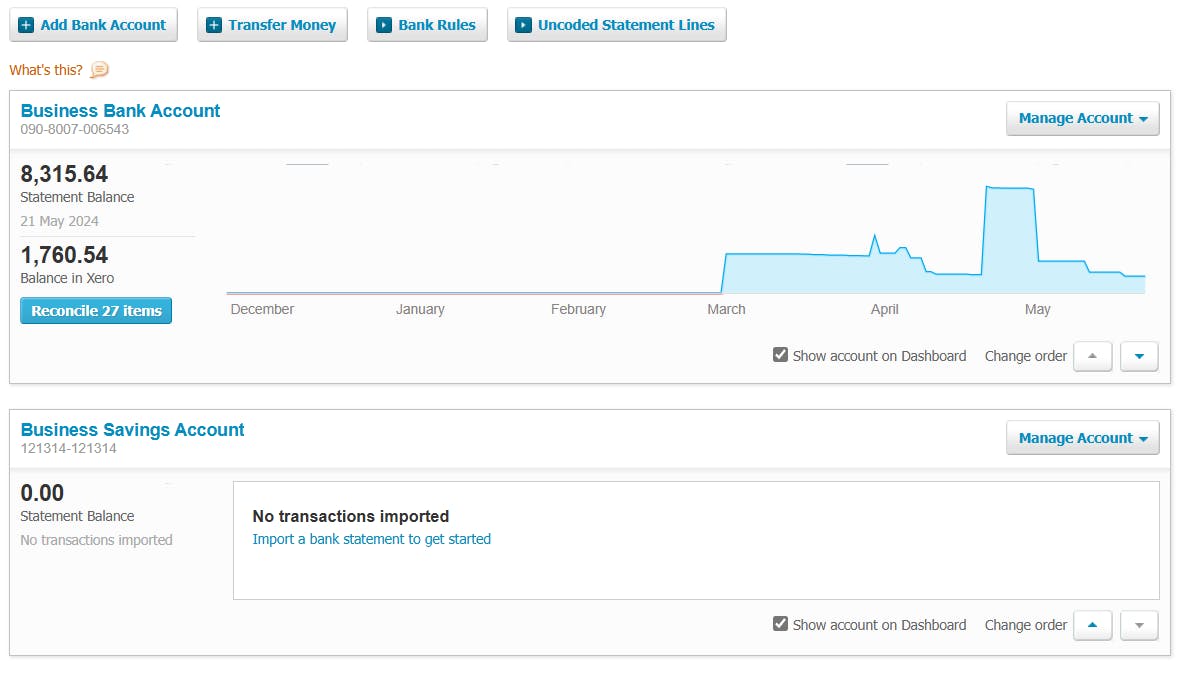

- Bank reconciliation that actually tries to help you with suggested matches

Plus, QuickBooks's app marketplace is like a candy store for accountants.

Need something specific? There's probably an app for that.

Let's Talk Money: $30,000 vs $1200

Okay, let's get real about costs. NetSuite? We're talking five figures a year. Ouch. QuickBooks Online? You're looking at $30 to $200 a month. That's a pretty big difference, right?

If you're not using all of NetSuite's features (and let's be honest, most businesses aren't), that's a lot of money going down the drain.

Imagine what you could do with those savings, or as President Trump would say, 'Yuge Savings. Biggest Savings Ever.'

User-Friendliness: Because Life's Too Short for Complicated Software

I've seen too many people pull their hair out trying to navigate NetSuite. It's powerful, sure, but it's also... well, let's say it's got a learning curve.

The vast ecosystem of NetSuite requires specialists that you'll have to hire and pay continuously. For a large enterprise, that's not a big deal. It's even essential.

But for SME's, the lines are more blurred, the decision more nuanced.

QuickBooks Online, on the other hand, is like that friend who's always easy to talk to:

- The interface is intuitive

- New team members can pick it up quickly

- Common tasks are straightforward

Trust me, your accounting team will thank you.

Scaling Up: Building Your Financial Tech Stack

Now, NetSuite fans will tell you it's great for scaling. And they're not wrong. But let me let you in on a little secret: QuickBooks Online offers a different kind of scalability.

With QuickBooks, you can start small and add on as you grow.

Need hardcore inventory management? Integrate a specialized tool such as Fishbowl.

Want top-notch payroll? Hook up ADP or Gusto.

It's like building with Legos instead of buying a pre-built castle. You get exactly what you need, nothing more, nothing less.

When QBO Might Be Your New Best Friend

In my experience, switching to QuickBooks Online makes a lot of sense if:

- You're paying for a bunch of NetSuite features you never touch

- The cost and hassle of managing NetSuite are giving you a headache

- Your team keeps grumbling about how complicated NetSuite is

- You want a more flexible, mix-and-match approach to your financial software

- You find yourself saying, "There's gotta be an easier way to do this" when using NetSuite

Real Talk from the Trenches

I've heard from plenty of folks who've made the switch. One controller told me:

"QuickBooks Online had its quirks, sure, but it let me and my team do our jobs without all the fuss. Plus, whatever it didn't have out of the box, we could usually find an app to fill the gap."

But I'll be straight with you - it's not for everyone. If you're gunning for an IPO or need to impress some serious investors, you might want to stick with NetSuite. As one CEO put it:

"The street trusts NetSuite. That trust alone can bump up your valuation enough to offset the cost."

Wrapping It Up

NetSuite is a beast, and for some companies, that's exactly what they need. But for a lot of businesses I've worked with - especially our data migration clients - QuickBooks Online is like a breath of fresh air - it's simpler, it's cheaper, and it gets the job done.

My advice? Take a good, hard look at what you actually need. Are you using even half of what NetSuite offers? Could you piece together a more efficient system with QuickBooks Online at its core?

If you're nodding your head, it might be time to make the switch.

FAQs: Switching from NetSuite to QuickBooks Online

Why should I consider switching from NetSuite to QuickBooks Online?

Switching to QuickBooks Online (QBO) can save you money, simplify your accounting processes, and provide a more user-friendly experience. If you're not utilizing all of NetSuite’s advanced features, QBO offers essential accounting tools with the flexibility to integrate additional apps as needed.

What features does QuickBooks Online offer compared to NetSuite?

QuickBooks Online provides solid core accounting features, basic inventory management, payroll integration, and an intuitive bank reconciliation process. While it may not offer the extensive feature set of NetSuite, it covers the essentials for most small to medium-sized businesses.

How much can I save by switching to QuickBooks Online?

NetSuite can cost five figures annually, while QuickBooks Online ranges from $30 to $200 per month. The potential savings are substantial, especially if you’re not leveraging all of NetSuite’s capabilities.

Is QuickBooks Online easier to use than NetSuite?

Yes, QuickBooks Online is known for its user-friendly interface and ease of use. It has an intuitive design that allows new team members to quickly get up to speed, reducing the learning curve associated with more complex systems like NetSuite.

Can QuickBooks Online scale with my business?

QuickBooks Online offers a different kind of scalability by allowing you to start with the basics and add specialized tools as needed. This mix-and-match approach lets you build your financial tech stack according to your growing business needs.

What are the signs that my business should switch to QuickBooks Online?

Consider switching if you’re paying for NetSuite features you don't use, finding NetSuite costly and cumbersome to manage, hearing complaints from your team about its complexity, or looking for a more flexible financial software solution.

Are there any situations where NetSuite might be a better choice?

If your company is preparing for an IPO or needs to impress investors, NetSuite’s robust reputation can be beneficial. In these cases, the trust and credibility associated with NetSuite might justify the higher costs.

What do other businesses say about switching to QuickBooks Online?

Many businesses report that QuickBooks Online allows them to perform their accounting tasks with less hassle and cost. They appreciate the ability to integrate additional apps to fill any gaps, making QBO a customizable and efficient solution.