AI in QuickBooks - Real-World Transformations

For QuickBooks users, managing finances and bookkeeping can sometimes feel like navigating a maze. The good news is that artificial intelligence (AI) is transforming the landscape, making these tasks more efficient and less time-consuming.

🚀 Boost Your QuickBooks Experience with AI! 🚀

AI is revolutionizing QuickBooks, making financial management more efficient and less time-consuming. Here’s how:

🔍 Automated Data Entry: AI-powered tools extract data from receipts, invoices, and bank statements, reducing manual effort and errors.

💡 Smart Invoicing: AI generates and sends invoices automatically, improving cash flow and saving you time.

🔮 Predictive Analytics: Gain insights into future cash flows, expenses, and revenue, helping you make informed decisions.

🔐 Fraud Detection: AI flags unusual transactions, enhancing your financial security.

✨ QuickBooks’ Built-In AI:

📸 OCR for Receipts: Snap a photo, and QuickBooks extracts transaction details automatically.

🤖 Intuit Assist: Collaborate with AI for personalized insights, task automation, and proactive suggestions.

Intuit embraced AI way before the hype

You may have already used some of the AI features present in QuickBooks, especially with the AI app.

OCR for Transaction Details from Receipts

One of the standout AI features in QuickBooks is Optical Character Recognition (OCR), which simplifies the task of entering transaction details from receipts.

How It Works: OCR technology scans receipts and automatically extracts important information such as the date, amount, merchant name, and expense category. This data is then seamlessly integrated into your QuickBooks account.

Benefits:

- Time Savings: No more manual data entry. Users can simply snap a photo of their receipt, and QuickBooks does the rest.

- Accuracy: OCR reduces the risk of human error, ensuring that transaction details are correctly recorded.

- Efficiency: Streamlines the expense tracking process, making it easier to keep accurate financial records.

Real-World Example: Emily, who runs a small bakery, used to spend hours entering receipt details into QuickBooks. With OCR, she now just takes a photo of her receipts with her smartphone, and the details are automatically entered into QuickBooks. This has saved her countless hours and improved the accuracy of her records.

Intuit Assist: Enhancing Collaboration with AI

Intuit, the parent company of QuickBooks, recently announced a groundbreaking feature: Intuit Assist. This AI-powered tool is designed to enable collaboration with AI inside QuickBooks Online (QBO).

What is Intuit Assist?

Intuit Assist is a smart assistant embedded within QuickBooks Online. It leverages AI to provide users with personalized insights, automate tasks, and offer proactive suggestions to optimize their financial management.

You can also watch the announcement for Intuit Assist.

Key Features:

- Automated Insights: Intuit Assist analyzes your financial data and provides actionable insights to help you make informed decisions.

- Task Automation: From categorizing transactions to generating financial reports, Intuit Assist can automate a wide range of tasks, reducing the manual workload.

- Proactive Suggestions: The AI assistant can identify potential issues or opportunities in your financial data and suggest actions to address them.

Benefits:

- Enhanced Productivity: By automating routine tasks, Intuit Assist frees up your time to focus on strategic business activities.

- Informed Decision-Making: With personalized insights and suggestions, you can make better financial decisions, improving your business outcomes.

- Seamless Collaboration: Intuit Assist can help teams work more efficiently by providing real-time insights and recommendations, fostering better collaboration.

Real-World Example: Mark, a financial consultant, uses Intuit Assist to streamline his workflow. The AI assistant automatically categorizes his clients' transactions, generates insightful reports, and even highlights areas where clients can save money or improve cash flow. This has not only enhanced Mark's productivity but also provided his clients with more value.

Before AI Integration

Scenario 1: Manual Data Entry Before AI, data entry was a manual and labor-intensive process. Accountants and business owners had to input transaction details, categorize expenses, and reconcile bank statements manually. This often led to errors and consumed a significant amount of time.

Scenario 2: Invoice Processing Creating and sending invoices was another time-consuming task. Users had to generate invoices manually, ensure accuracy, and follow up on payments. Delays in invoicing could lead to cash flow issues and strained client relationships.

After AI Integration

Scenario 1: Automated Data Entry

With AI, data entry has become a breeze. AI-powered tools can automatically extract data from receipts, invoices, and bank statements, and input it into QuickBooks with high accuracy. This not only saves time but also reduces the risk of human error.

Real-World Example: Sarah, a small business owner, used to spend hours each week entering data into QuickBooks. After integrating an AI-powered tool, she now spends just a few minutes reviewing the automatically entered data. This has freed up her time to focus on growing her business.

Scenario 2: Smart Invoicing

AI has transformed the invoicing process by automating the creation and sending of invoices. AI can generate invoices based on predefined templates, track due dates, and even send reminders to clients for overdue payments.

Real-World Example: John, a freelance consultant, struggled with late payments from clients. After adopting an AI-driven invoicing system, his invoices are automatically generated and sent as soon as the work is completed. The system also sends follow-up reminders, which has significantly improved his cash flow and reduced the time he spends on administrative tasks.

Additional AI Benefits for QuickBooks Users

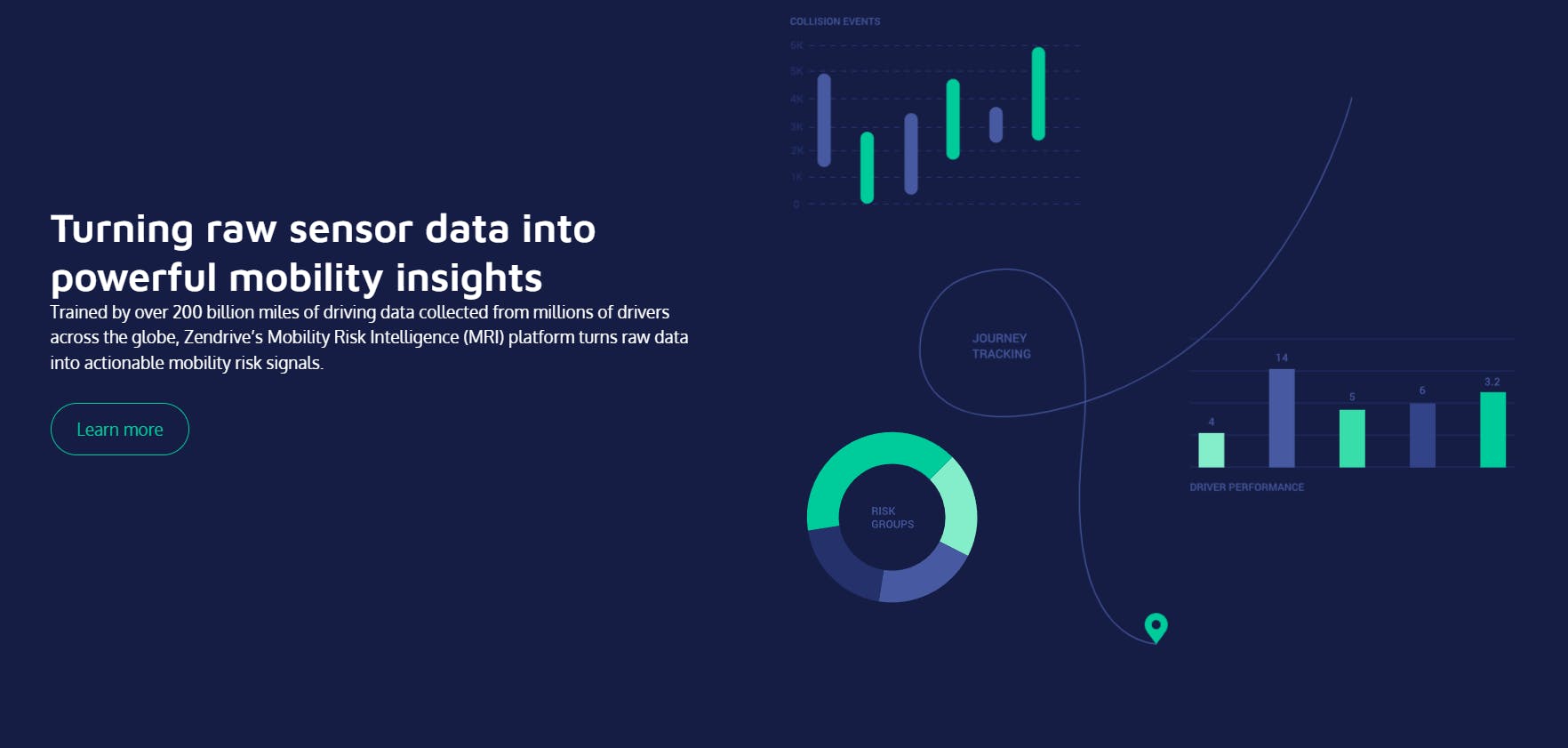

1. Predictive Analytics: AI can analyze historical financial data to provide insights and predictions about future cash flows, expenses, and revenue. This helps businesses make informed decisions and plan more effectively.

Example: A retail store owner used AI to predict seasonal sales trends, allowing them to optimize inventory levels and avoid overstocking or stockouts.

2. Fraud Detection: AI can identify unusual patterns and flag potentially fraudulent transactions, enhancing the security of financial data.

Example: A medium-sized enterprise detected a series of suspicious transactions through an AI-powered fraud detection tool, preventing significant financial losses.

3. Customer Insights: AI can analyze customer payment patterns and provide insights that help businesses tailor their services and improve client relationships.

Example: A subscription-based service provider used AI to identify customers who were at risk of churning. They were able to reach out proactively with special offers, improving customer retention.

Conclusion

Integrating AI with QuickBooks is not just a trend; it’s a game-changer for businesses of all sizes. AI allows QuickBooks users to focus on what truly matters—growing their business. The transformation from manual processes to AI-driven efficiency is evident in real-world examples, showcasing the tangible benefits that AI brings to the table.