Intuit Acquires Zendrive's Mobility Risk Intelligence Technology

Intuit has announced an agreement to acquire technology from leading mobility risk intelligence provider Zendrive.

Intuit has announced an agreement to acquire technology from leading mobility risk intelligence provider Zendrive. This strategic move aims to accelerate innovation and adoption of Credit Karma's usage-based auto insurance product, Karma Drive.

Bringing Zendrive's Expertise on Board

As part of the acquisition, certain Zendrive employees, including CEO Dennis Ellis and Co-founder and CTO Pankaj Risbood, will join Credit Karma to bolster the company's insurance offerings.

Democratizing Access to Fair Insurance

The acquisition aligns with Intuit's mission to power prosperity around the world and its goal of doubling the household savings rate of customers by 2030. Joe Kauffman, President of Credit Karma, highlighted the need for accessible and transparent insurance pricing:

"Insurance costs have increased dramatically, and Americans are looking for ways to minimize driving expenses in this high-inflation environment. Karma Drive gives our members access to personalized discount offers based on safe driving habits, without first having to purchase a policy."

Empowering Consumers with Driving Data

Karma Drive's telematics-driven model has already yielded more than 4 million discounted policy offers for Credit Karma members. By providing insights into driving behaviors, it offers carriers better visibility into driving risk factors, with member consent.

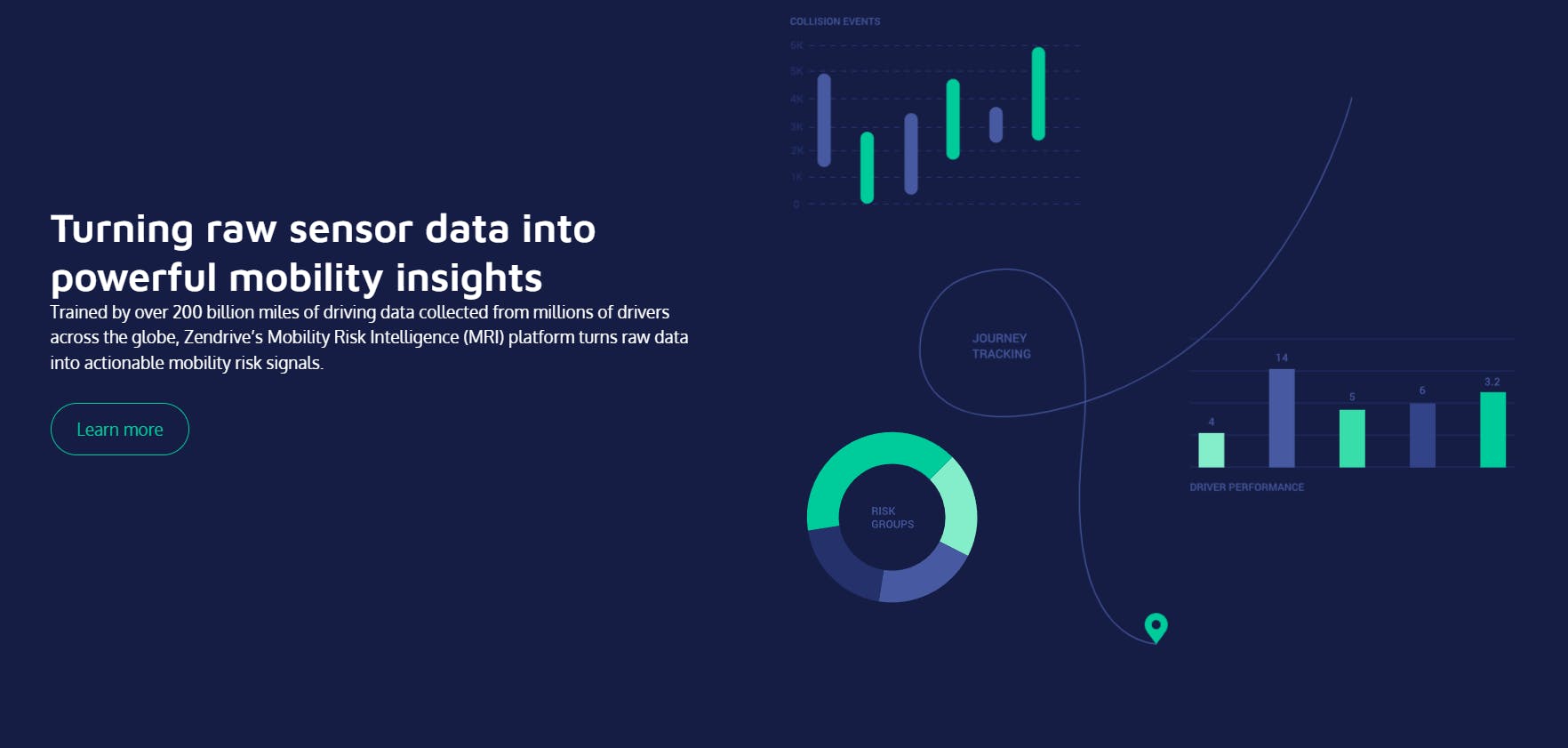

Zendrive's Mobility Risk Intelligence Platform

Zendrive's Mobility Risk Intelligence (MRI) platform integrates mobility data for smarter underwriting, claims processing, and roadside assistance. Key solutions include:

- IQL for Publishers: Generate new revenue streams and user savings through integrated test drive experiences.

- Behavioral Improvements: Customizable UBI programs reduce collision risks by up to 49%.

- Acquire Preferred Risk: Offer personalized insurance quotes based on driving behavior.

- Claims Automation: Automate FNOL (First Notice of Loss) and streamline claims processes.

- Advanced Risk Modeling: Develop precise risk models for accurate pricing and segmentation.

Benefiting Multiple Industries

Zendrive's digital, behavior-based solutions benefit industries such as automotive, insurance, OEMs, consumer apps, fleets, and telcos.

Intuit expects to close the transaction in Q4 FY24, further solidifying its commitment to helping Americans save on essential expenses like insurance.