Beyond Numbers: Diversifying Revenue Streams for Accounting Practices

Think of it like having multiple income streams – it not only makes your business more resilient but also opens up new opportunities for growth. So, let's explore some fresh ideas to help you go beyond the traditional tax and audit services.

The Value-Added Advisory Bandwagon

Remember when your parents used to say, "Don't just focus on making money; focus on adding value"? Well, they were on to something. Clients these days are hungry for value-added advisory services that go beyond just crunching numbers. They want strategic insights, business planning, and guidance to help them navigate the ever-changing landscape of regulations, taxes, and market trends.

Business Consulting and Strategic Planning

Imagine being the go-to guru for your clients, helping them make informed decisions about their business strategies, growth plans, and risk management. By offering business consulting and strategic planning services, you can leverage your deep understanding of their finances and operations to provide tailored recommendations that drive their success.

Financial and Operational Analyses

You know the drill – analyzing financial statements, forecasting cash flows, and identifying areas for cost optimization. But what if you took it a step further and offered comprehensive operational analyses? By diving deep into your clients' business processes, you can uncover inefficiencies, streamline operations, and unlock hidden opportunities for profitability.

Succession and Exit Planning

Every business owner dreams of a smooth transition, whether it's passing the baton to the next generation or cashing out after years of hard work. As an accounting firm, you're uniquely positioned to guide your clients through the intricate world of succession and exit planning. From valuation to tax implications to structuring the deal, your expertise can be invaluable.

Embracing Technology and Automation

Let's face it – the world is going digital, and accounting is no exception. While some might see technology as a threat, savvy firms recognize it as an opportunity to streamline processes, enhance efficiency, and offer innovative services to clients.

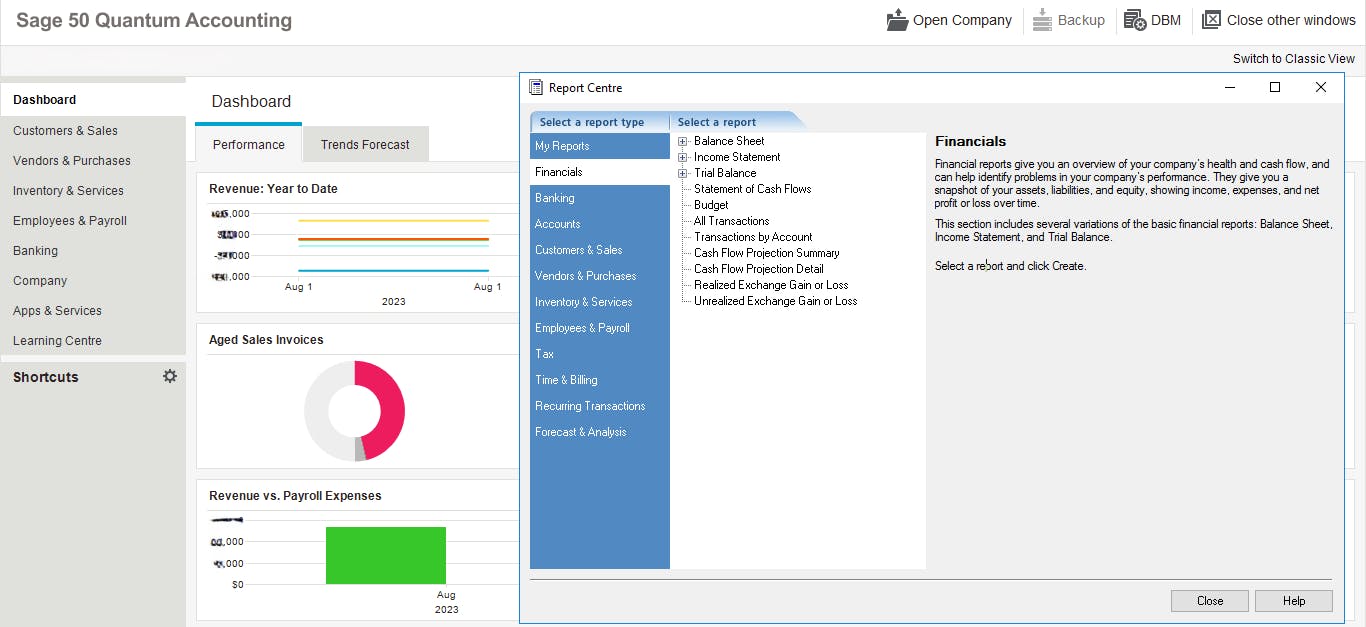

Cloud Accounting and Bookkeeping Services

Gone are the days when bookkeeping was a tedious, manual process. By embracing cloud-based accounting software and offering bookkeeping services, you can provide real-time financial visibility to your clients while freeing up their time to focus on their core business.

Cybersecurity and Data Protection

In the age of data breaches and cyber threats, businesses are increasingly concerned about the security of their financial information. As an accounting firm, you can leverage your expertise to offer cybersecurity consulting, risk assessments, and data protection services, positioning yourself as a trusted partner in safeguarding your clients' sensitive data.

Automation and Process Optimization

Repetitive tasks, manual data entry, and error-prone processes – sound familiar? By implementing automation and process optimization solutions, you can streamline your firm's operations, reduce errors, and free up valuable resources to focus on higher-value services for your clients.

Specialization and Niche Markets

While being a generalist has its advantages, specializing in a particular industry or service can help you stand out from the crowd and command premium pricing. Think about it – when you become the go-to expert in a niche market, you become invaluable to your clients.

Industry-Specific Expertise

Whether it's healthcare, real estate, or the tech sector, developing deep industry-specific knowledge can set you apart from the competition. By understanding the nuances, regulations, and best practices of a particular industry, you can offer tailored solutions that resonate with your clients' unique needs.

Specialized Services

Tax planning, forensic accounting, litigation support, or international taxation – the possibilities are endless when it comes to specialized services. By honing your skills in a specific area, you can position yourself as the go-to expert and command higher fees for your niche expertise.

Building a Strong Brand and Network

In the world of accounting, reputation and relationships are everything. By investing in your brand and cultivating a strong professional network, you can open doors to new opportunities and attract the right clients.

Thought Leadership and Content Marketing

Share your expertise with the world by creating valuable content, such as blog posts, whitepapers, or webinars. Establish yourself as a thought leader in your field, and watch as potential clients flock to your firm for guidance and insights.

Strategic Partnerships and Referrals

Collaboration is key in today's interconnected business landscape. Forge strategic partnerships with other professionals, such as lawyers, financial advisors, or business consultants, and tap into their networks for referrals and cross-selling opportunities.

Community Involvement and Networking

Don't underestimate the power of face-to-face interactions. Attend industry events, join professional associations, and actively participate in your local community. By building relationships and expanding your network, you'll not only raise your firm's visibility but also create opportunities for new business.

At the end of the day, diversifying your revenue streams is about future-proofing your accounting practice and staying ahead of the curve. By embracing value-added services, technology, specialization, and strategic branding, you'll be well on your way to unlocking new growth opportunities and cementing your firm's position as a trusted partner for your clients.

So, what are you waiting for? It's time to go beyond the numbers and explore the world of possibilities that lie ahead. Remember, success isn't just about crunching numbers – it's about adapting, innovating, and continuously adding value. Happy diversifying!